Especially the last few years have given proof of how closely the European road freight market is intertwined with international production and supply chains and how dependent it is on global events. During these years, there have been several political shifts that have significantly increased the pressure on the European economy and thus also on the road freight business. One drastic event was the United Kingdom's exit from the European Union (Brexit) which unsettled the economy and imposed challenges – and thus affected the transport market in general. After Brexit, the growing problem of truck driver shortages in the market became most evident.

The COVID-19 pandemic and its impact on business and logistics

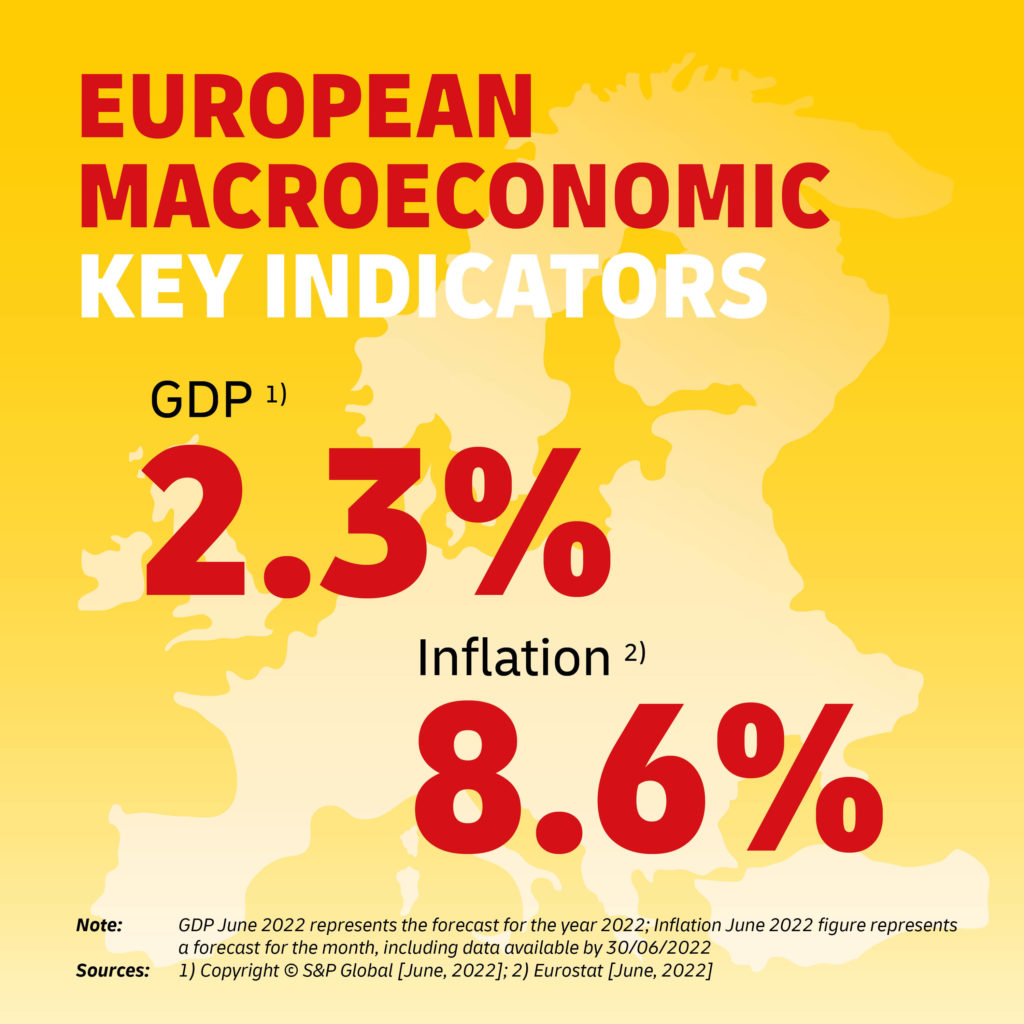

The outbreak of the COVID-19 pandemic also had far-reaching consequences. Restrictions imposed across Europe to contain the pandemic severely limited production and trade activities within the European economic area and along global supply chains – or even brought them to a standstill. The lower economic strength is reflected in an only moderate European growth forecast for 2022. S&P Global (formerly IHS Markit) predicted in June a GDP for 2022 of 2.3% (-1.4% compared to the growth forecast at the beginning of the year), which is accompanied by rising inflation or a high price level. Contrary to the European Central Bank's (ECB) medium-term inflation target of 2%, the annual inflation rate in the euro area was 8.6% in June 2022 (Eurostat, statistical office of the European Union).

Disrupted supply chains have posed huge challenges to many sectors of the economy. This also applies to the automotive industry, including truck production, which has been severely affected by supply problems and delays since the pandemic-related “semiconductor crisis”.

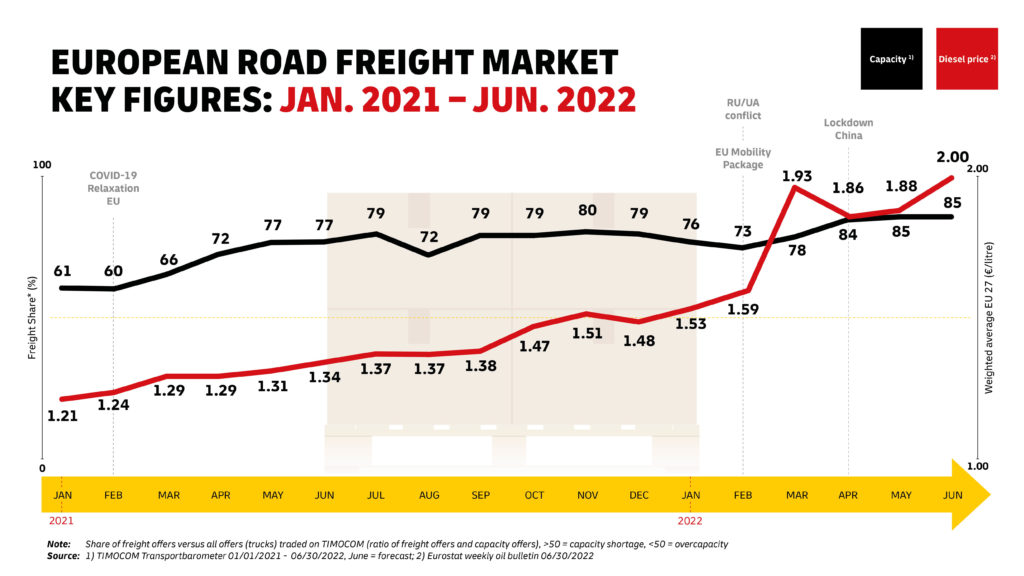

The gradual repeal of COVID-19 measures since the beginning of 2021 was accompanied by so-called catch-up effects, which led to a sharp increase in volumes on the market due to the resumption of production. As shown in the illustration ("European Road Freight Market Key Figures"), this, combined with the prevailing lack of trucks and drivers, led to a significant capacity shortage in European road freight transport, which has persisted ever since.

The war in Ukraine intensifies existing bottlenecks

The outbreak of war in Ukraine in the spring of 2022 has further exacerbated the already tense situation in European road freight. The further decline in the already insufficient number of drivers on the European market has worsened the prevailing capacity bottlenecks. In June, TIMOCOM, for example, reported a dramatic shortfall of capacity in the ratio 85:15 (demanded capacity / supplied capacity) in the European road network.

The European Commission’s package of sanctions, including the import ban on Russian oil and increasingly also reductions in gas, are resulting in a record high in energy and diesel costs, which were already at a substantial price level before. Eurostat reports a weighted average diesel price of 2.00 euros per liter for the 27 European member states for June. Around a year ago, this was only 1.34 euros per liter (June 2021) and has thus risen by a full 49%.

Consequently, the combination of these war-related impacts is putting increased cost pressure on transportation services. Persistently tight market capacities and high transport costs driven by capacity and diesel prices are thus currently characteristic of European road freight.

The EU Mobility Package and new Lockdowns in China present further challenges to the road freight market

The EU Mobility Package which was adopted by the European Parliament in 2020 primarily to promote European standardization in the field of freight forwarding and logistics, has a capacity-reducing effect and therefore represents an additional burden for European road freight transport in particular.For example, the EU Mobility Package includes the obligation to return vehicles within the scope of cabotage. This came into force in February 2022 and must be transposed into national law throughout the EU. The impact on global trade resulting from the new lockdowns in China, which further add to the pressure on supply chains, is aggravating the situation.

Finally, the industry is concerned about climate change – and not just since yesterday. The sustainable transformation of road freight remains a crucial task that must be addressed now and proactively.

Given the developments outlined above, there is no indication of an imminent turnaround or that the situation will improve in June. Available transport capacity will remain tight for the time being, and contrary to the traditional cool-down in the summer with its decline in shipment volumes, the situation on the road freight market is likely to remain tense. It can also be assumed that the price level for logistics services will be above pre-pandemic and pre-war levels in the longer term. It remains to be seen how the additional strikes in shipping and road freight will further impact global production and supply chains.

DHL Freight began at an early stage to continuously assess the influences on capacity and the cost situation in the road network and to derive targeted measures. Consistent quality in the transport and delivery of the shipment is thus ensured. Especially in such a volatile situation, open and transparent communication is a top priority for DHL Freight. That is why we will be reporting monthly on current market developments from now on.