Goods that are commercially imported into or exported from the EU must pass through customs. We have summarized for you here how customs clearance works in detail, how goods must be declared, or what, for example, freight forwarders must consider when importing goods from third countries or exporting them to non-EU countries.

First Step of Customs Clearance: The Declaration

The customs declaration is the document on which the imported or exported goods are specified. Either the owner (a private person or a company) declares the goods or an authorized person, for example a logistics or customs service provider.

Customs declarations are standardized throughout the EU. As a general rule, the declaration must be submitted to the customs office of the country where the goods arrive. If a container reaches Rotterdam, its contents are declared at the Dutch customs office. The same applies to exports: if goods leave the European Customs Union, e.g., via Frankfurt Airport, German customs is responsible for the export procedure.

Exception: Centralized Clearance

It is also possible to send the declaration to the customs office of the country in which a company is located – regardless of whether the goods are imported into another Member State. This is called centralized clearance, for which an approval is required. But to qualify for this, a company must be authorized for simplified procedures. In formal terms: it must have the status of an Authorized Economic Operator (AEO).

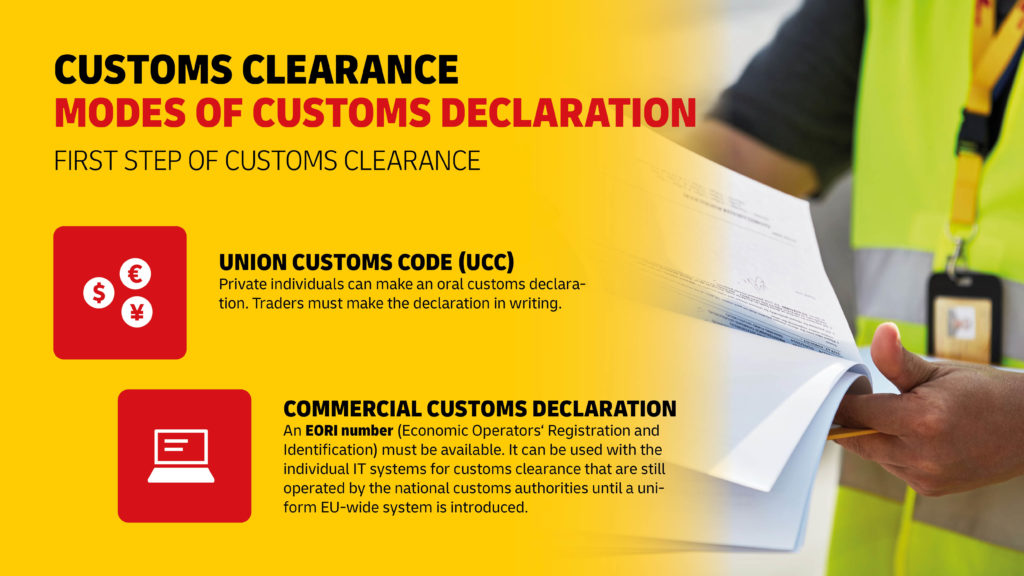

Modes of Customs Declaration

The Union Customs Code (UCC) stipulates an electronic customs declaration. Since there is no common IT system yet, the declaration can still be made in written or oral form. However, the latter applies mainly to luggage or private consignees of small shipments. For a written declaration, the EU single administrative document (SAD) must be used.

The precondition for a trade customs declaration is the EORI number (Economic Operators' Registration and Identification). It is applied for at the competent customs authority of the EU country in which a company has its registered office. The EORI number can be used with the individual IT systems for customs clearance that are still operated by the national customs authorities until a uniform EU-wide system is introduced.

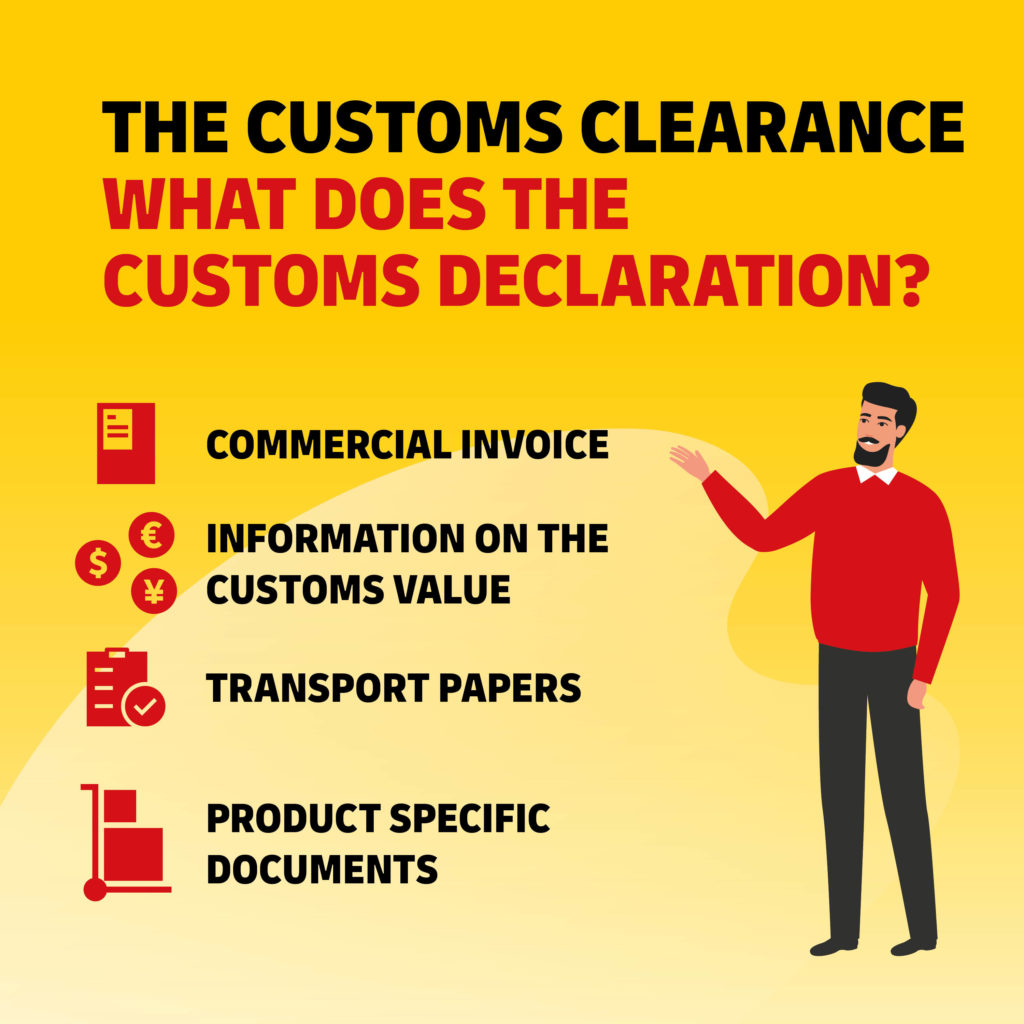

Content of the Customs Declaration

The content of the declaration depends on the traded goods. Regularly required documents are:

- Commercial invoice: The standard accompanying document for goods in foreign trade. If goods have no commercial value (e.g., in case of gifts), a so-called pro forma invoice must be presented.

- Information on the customs value: Everything that can affect the customs value of a good: e.g., exchange rates, purchasing commissions, or transport and insurance costs. For non-commercial shipments or a customs value of less than 20,000 euros, the customs value declaration can be dispensed with.

- Transport papers and documentation of any previous customs procedure.

- Product specific documents: Permits or certificates: e.g., import permit, certificate of origin, certificate of authenticity, declaration on excise duty, or species protection documents.

What does Customs Inspect and How?

Acceptance and Preliminary Examination

The customs declaration is received and pre-checked by the competent customs office: Are the information and documents complete? If there is any reason for objection, the goods will not be accepted for clearance.

Inspection

Once the declaration has been accepted and the consignment presented, the accuracy of the information is verified and the goods can be subject to customs inspection. In addition to the visual inspection, samples and specimens may also be taken. At the end of the inspection, the customs certificate is issued.

Release of Goods and Admission to Free Circulation

Finally, the goods are handed over to the declarant and may enter free circulation upon import or leave the Customs Union upon export. If customs duties are payable (customs fees and taxes), the goods are released only after payment of these duties.

How Long Does Customs Clearance Take?

How much time a customs clearance takes depends on the type and size of the shipment – and also on the workload of the customs office. You can do your part to speed things up by making sure the declaration is complete and accurate.

Conclusion

Customs clearance involves several steps, during which numerous formal conditions must be met. It is important to be well informed in order to fully comply with all regulations and thus avoid possible fines. With regard to customs and value-added tax, there are a number of pitfalls to be aware of that can prove fatal, especially for those who rarely file customs declarations or lack sufficient expertise.

Anyone who loses track of the many paragraphs of the UCC can obtain advice from customs service providers such as Gerlach, a leading neutral customs service provider in Europe and a wholly owned subsidiary of Deutsche Post DHL Group. Cooperation with customs experts can not only speed up clearance but save costs that might arise from potential penalty fees due to a lack of experience. The international movement of goods is both an opportunity and a risk – but the latter can be significantly reduced with the right expertise on your side.