<!--[CDATA[

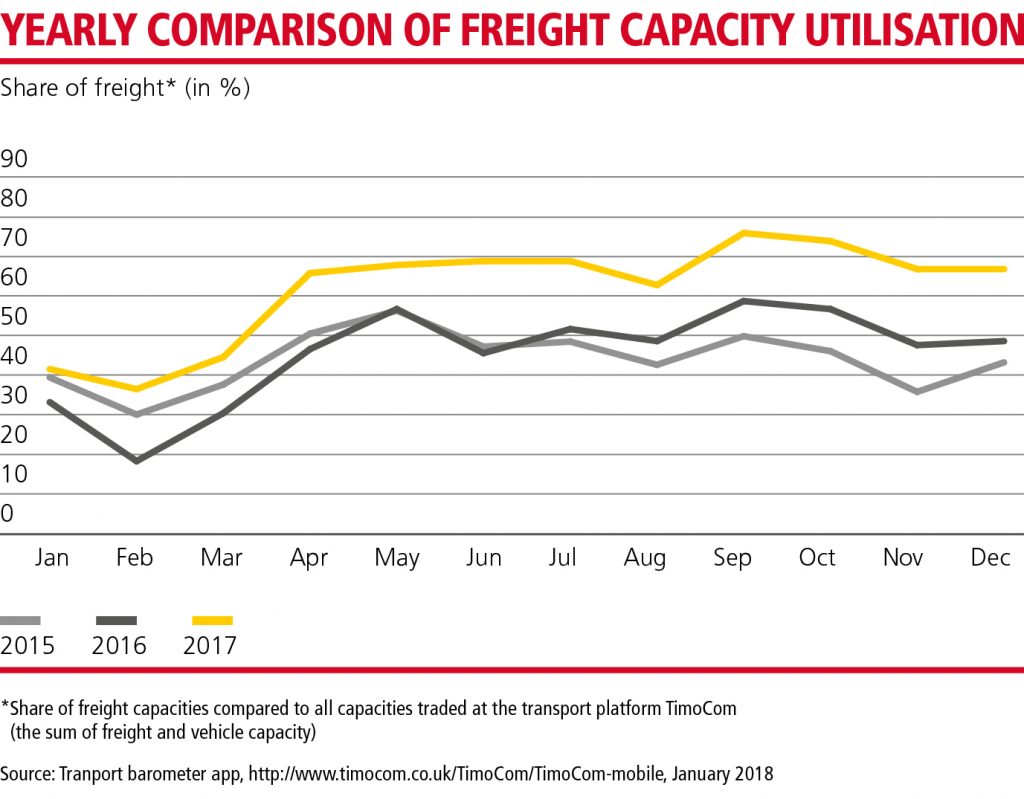

Commentary on the current situation in the European logistics industry and the load factor at the turn of the year 2017/18 from Martin Veen, Head of M&A & Strategic Projects, DHL Freight. Due to what are in general excellent macroeconomic conditions, what was once a largely stable demand for European road freight transport has been on the rise. The record cargo utilization seen in September and October 2017 stabilized in the last two months of the year, albeit still at a high level. The systemic bottlenecks in capacity have sometimes made it challenging to maintain quality standards when servicing the existing demand for cargo space. Nevertheless, there were significant differences within Europe, with strong fluctuations in demand between countries. While spurts of growth were seen in some regions, other markets proved quite vulnerable to local influences such as currency fluctuations. After a moderate to stable beginning to 2018 in many countries, current market conditions suggest that demand for cargo space will gradually rise again in the coming months. However, there are uncertainties whose impact on the overall development is difficult or impossible to estimate.

Driver and staff shortage

The impact of the continuing shortage of drivers reached its latest peak in the second half of 2017. Rising freight rates, unsatisfied quality promises, and the occasional opportunism of carriers presented considerable challenges for market participants. Regionally, Central and Eastern Europe is particularly affected by a sustained lack of logistics personnel. The necessary design and enforcement of uniform and suitable legal frameworks is still lagging throughout Europe, thus hampering long-term predictability.

Weekly rest periods

So far, it has been France, Germany, and Belgium that have particularly monitoring compliance with the clause in the "European Agreement Concerning the Work of Crews of Vehicles Engaged in International Road Transport" (AETR) concerning where drivers are to spend their weekly rest period. The new regulation stipulates that it can no longer be spent in their vehicles. Once the European Court of Justice reaffirms this clause and declares it to be lawful, a significant increase and extension of controls to the other EU countries is to be expected. It will important to see to what extent general price structures and transit times on certain routes across Europe will have to change as a result.

Brexit

Many competitors are currently not signing long-term contracts for transport to the United Kingdom, but the actual impact of the British exit from the EU remains uncertain. There are also efforts by market participants to develop alternatives to existing trade routes and, for example, to send ferry transports across the North Sea.

Currency fluctuation

The current weakness of the British pound has yet to be fully reflected in rates for shipments to the United Kingdom, which further complicates the local market situation with corresponding price uncertainty. In addition to the pound weakness, the current growth in the Czech crown (CZK) is causing higher costs and greater uncertainty for forwarding companies from this region.